SETC UBS TOS

UNITED BUSINESS SOLUTIONS (UBS) SETC REFERRAL PROGRAM

TERMS OF SERVICE AND PARTICIPATION AGREEMENT

1. Authorization and Contract

By executing this UBS Self-Employed Tax Credit (“SETC”) Program Terms of Service and Participation Agreement (“Agreement”), you (“You”) hereby apply for legal authorization to participate in the SETC referral program (as described in greater detail below) sponsored by iHub Inc., a Delaware corporation (“iHub Inc.”), along with certain of iHub Inc.’s affiliated companies (collectively, ‘”UBS” or the “Company”), enter into a contract with the iHub and accept all terms and conditions hereof and of all other applicable UBS agreements, including, but not limited to, the Electronic Signature Affiliate Application, the Privacy Notice and the Terms of Service. This Agreement is created to provide detailed guidelines and limitations for You and for all other independent business entities or individuals wishing to participate in the UBS SETC affiliate program (the “UBS SETC Program”) as an independent business affiliate (an “Affiliate”). You and UBS shall each be referred to herein as a “Party” and collectively, as the “Parties”.

2. Description of SETC and Purpose of UBS SETC Program

What Is SETC?

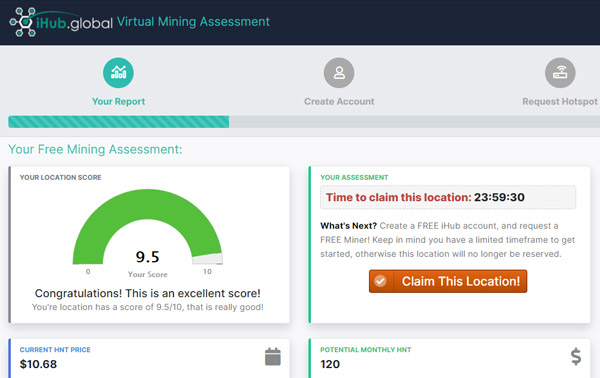

The SETC is a tax credit established by the American Rescue Plan Act to support self-employed individuals facing financial hardship due to COVID-19. The U.S. Government has set aside millions in tax credits for self-employed individuals affected by the COVID-19 pandemic. Many accountants did not (and still do not) know this exists.

United Business Solution (“UBS”) and Sichenzia Ross Ference Carmel LLP LLC (“Sichenzia”) have partnered to create a seamless referral process for self-employed professionals who qualify for and wish to claim the SETC. United Business Solutions is the company that has developed the software and web-based platform to facilitate the SETC submission process, and Sichenzia is the accounting firm that assists the self-employed individuals in the preparation of the SETC documentation for claiming the SETC,

Sichenzia and UBS receive a contingent processing fee (the “Fee”) from their clients who receive SETC refunds or tax credits from the U.S. Treasury. The U.S. Treasury takes approximately six (6) months or longer to review a completed SETC refund or credit application and to make payment of approved SETC refunds or tax credits.

UBS has entered into a Referral Partner Agreement with an affiliate of UBS to act as a referral partner and agent for the marketing and sale of the services offered by UBS and Sichenzia. Under the terms of the Referral Agreement, UBS will receive a referral fee (the “Referral Fee”) from UBS/Sichenzia for each self-employed individual (the “client”) referred to UBS/Sichenzia which client thereafter enters into an accounting and service agreement with Sichenzia and, as a result of Sichenzia’s and UBS’s efforts, receives a SETC refund or tax credit. As discussed in greater detail in this Agreement, UBS/Sichenzia have partnered with a financial institution to provide to those clients who so elect for the advance funding of the SETC refund or tax credit, which will greatly speeds up the receipt of funds to the clients and to the referral partners.

UBS has developed the UBS SETC Program to allow qualifying UBS Affiliates to obtain a certain percentage of the Referral Fee earned by UBS and paid to UBS from such referrals. The amounts payable to the UBS Affiliates shall be set forth in, and shall be governed by, UBS’s SETC Affiliate Compensation Plan.

The purpose of the UBS SETC Program is to provide individuals or entities who agree to participate in the UBS SETC Program as independent UBS Affiliates and comply with the terms and conditions of this Agreement with the opportunity to earn commissions or referral fees by providing to UBS leads on potential SETC-qualifying self-employed individuals. UBS will provide these referrals to UBS/Sichenzia through the UBS/Sichenzia online portal. If UBS/Sichenzia determine that the referred self-employed individual qualifies for the SETC, Sichenzia/UBS will seek to enter into an accounting and service agreement with the individual. For those self-employed individual leads from UBS Affiliates resulting in Referral Fees, UBS will provide compensation to the UBS Affiliate responsible for the successful referral pursuant to the terms of the UBS SETC Compensation Plan.

3. Acknowledgement of Risk

Anyone participating in the UBS SETC Program as an UBS Affiliate hereby acknowledges that there is no guarantee that any of the self-employed individual referrals or leads will qualify for a SETC refund or tax credit. Similarly, there is no guarantee that any referred self-employed individual will enter into a contingent accounting and services agreement with Sichenzia/UBS or the individual will actually receive a SETC refund or credit from the U.S. Treasury resulting in fees to Sichenzia and UBS and Referral Fees payable to UBS. Accordingly, UBS does not represent or provide any assurance or guarantee that an UBS Affiliate participating in the UBS SETC Program will be successful and generate any referral fees or any other income.

Individuals and entities participating in this program operate at their own risk, understanding that there is a potential for positive results but also the potential that the participant will incur or suffer a net financial loss. Given the contingent nature of this opportunity and the many uncertainties and factors outside of the control of UBS, Sichenzia and UBS, the opportunity presents significant risks that a participant will not receive significant or any referral fees from the participant’s efforts or participation in the UBS SETC Program. In addition, participants in the UBS SETC Program should be aware that there may be a significant period of time between making even a successful referral and the actual receipt of earned referral fees by UBS from UBS/Sichenzia and the payment of an UBS Affiliate’s share of such referral fee. This is particularly the case where the self-employed individual client opts not to participate in the UBS advance program.

UBS and Sichenzia have established with a financial institution the ability for a qualifying self-employed individual to obtain an advance on the SETC refund which will result in an expedited payment of the referral fee to the self-employed individual and, consequently, expedited payment of the referral fees to UBS and to the referring UBS Affiliate. In any event, any participants that desire or require regular and current compensation should not participate in the UBS SETC Program.

4. Strict Adherence to Process for Submission of Referred

Self-Employed Individuals

UBS has established a process for all of UBS’s SETC affiliates to follow to refer potentially eligible self-employed individuals to UBS/Sichenzia for participation in the SETC Program. It is imperative that each UBS Affiliate strictly follow the referral process and not contact or attempt to contact either UBS or Sichenzia directly. Adherence to this referral submission process allows UBS to track the progress of submitted potentially eligible SETC self-employed individual leads, through the execution of the accounting and service agreement by the referred self-employed individual, the uploading of the individual’s tax return documentation, the completion of the required IRS paperwork for requesting the SETC tax refund or tax credit, the decision by the individual to either obtain an advance payment or to allow the filing with the IRS to be handled in the ordinary course of business and ultimately the IRS’s payment of the SETC tax refund or credit to the self-employed individual or to the bank funding the advance payment of the SETC tax refund, the remittance to UBS of UBS’s Referral Fee and finally UBS’s payment to the UBS Affiliate of its commission for referring the self-employed individual recipient of the SETC refund.

5. Partial or Complete Loss of Commission for Failure to Comply with Business Referral Process

In the event that an UBS Affiliate fails to comply with the procedure for referring self-employed individuals to UBS and to UBS/Sichenzia, the UBS Affiliate’s failure to follow the UBS SETC submission procedure could result in a significant risk of loss of the entire referral fee by UBS and of the affiliate’s commission and, if this behavior continues, termination as an UBS Affiliate. UBS, therefore, urges all Affiliates participating in its SETC Program to strictly comply with the lead submission procedures and under no circumstance seek to contact UBS or Sichenzia.

6. Consent to Sharing Certain Information on UBS Affiliate with UBS/Sichenzia

The UBS ERC Affiliate hereby consents and authorizes UBS to share certain of the Affiliate’s confidential identifying information with UBS and Sichenzia as necessary in connection with carrying out of UBS’s SETC Program. UBS, Sichenzia and UBS will maintain the confidentiality of all such information.

7. Becoming an UBS SETC Affiliate, SETC Commission Payout Requirements, Timing of Commission Payments and Related Matters

- Becoming An UBS SETC Affiliate:

To become an UBS SETC Affiliate, an applicant must comply with the following requirements:

- For individual-- Be of the age of majority (not a minor) in his or her state of residence;

- For Business Entities—Be duly formed or organized under the laws of the entity’s state or country of formation or organization;

- Execute this electronic Agreement; and

- Comply with the SETC Commission Payout Requirements and other applicable provisions of this Agreement.

- SETC Commission Payout Requirements:

• Valid Tax Information on Completed W-9 or W-8 - All independent SETC UBS Affiliates (referral partners) MUST have valid Tax Information submitted and validated on an IRS Form W-9 or W-8 prior to being eligible to receive payouts, found here:

https://setc.UBS.global/commissions under the Payout Settings > Tax Information Tab

• Valid Payout Method Set - All SETC UBS Affiliates (referral partners) MUST have a valid Payout Method submitted and validated prior to being eligible to receive payouts. (ACH / Check) found here:

https://setc.UBS.global/commissions under the Payout Settings > Payout Type

• Check Payments - Check payments for SETC Commissions are currently available, but will be used as a secondary payment method once ACH payments are live.

- Timing of Commission Payments:

• SETC Commissions are paid out on the 25th of each month (or, if not a Business Day, the next day that is a Business Day) for the previous month of all SETC deals that are in the status of “Completed.” Business Day means any day that is not a Saturday, Sunday or other day on which commercial banks are authorized or required by applicable law to remain closed in Vero Beach, Florida.

- Potential Income for Participants in UBS SETC Program

The UBS SETC Program is an exciting opportunity that rewards you for identifying and referring leads on eligible self-employed individuals or 1099 entities that might qualify for SETC tax credits from the U.S. Treasury Department’s Internal Revenue Service (“IRS”). The SETC program is a federal stimulus program authorized by the American Rescue Plan Act to self-employed individuals adversely impacted by COVID-19 pandemic.

The SETC is a specialized tax credit designed to provide support to self-employed individuals during the COVID-19 pandemic. It acknowledges the unique challenges faced by those who work for themselves, especially during times of illness, caregiving responsibilities, quarantine, and related circumstances. This credit can be a valuable resource for eligible individuals to help bridge financial gaps caused by unforeseen disruptions.

Commissions will vary due to a number of factors including, but not limited to, amount of taxes paid in 2020 and 2021 and other considerations. While calculations are performed by systematic calculation, and then reviewed by forensic auditors, neither UBS, Sichenzia nor United Business Solutions has control over the amounts approved and actually paid to a self-employed individual by the IRS or funded via advanced funding.

- Estimated Commissions

Any estimates provided by UBS or its referral partners of potential commissions earned by an independent UBS SETC Affiliate are not necessarily representative of the commissions that should be expected and should not be considered as guarantees or projections of your actual earnings from participating in UBS’s SETC Program. Commissions are purely estimates based on the UBS SETC compensation plan base level; however, the figures are not final until UBS receives confirmation from United Business Solutions and Sichenzia regarding the amount approved and paid by the IRS to the self-employed individual as a result of the SETC filing. The commissions are expressly contingent and dependent on the amounts ultimately received by the individual from the IRS and UBS’s share of the referral fees paid to it by United Business Solutions and Sichenzia under the Referral Partner Agreement. The Commission earned by an independent UBS SETC Affiliate is based on the UBS SETC Compensation Plan.

It is important to note that where the self-employed individual does not take advantage of the UBS/Sichenzia advance funding program there could be a significant delay between the time the self-employed individual submits its SETC refund or tax credit application to the IRS, the IRS completes its review, approves the application and issues a refund or tax credit to the individual, and UBS receives its referral fee and UBS remits payment of the UBS Affiliate’s share of such referral fee.

UBS SETC Affiliates must adhere to the terms of the UBS SETC Compensation Plan as set forth in official UBS materials and the UBS website. UBS SETC Affiliates shall not require or encourage other current or prospective clients or other UBS SETC Affiliates to participate in UBS SETC Program in any manner that varies from the program as set forth in this Agreement or in the UBS SETC Program materials.

- UBS’s Right to Offset Against Earned Commissions for Amounts Owed to UBS or any of UBS’s Affiliated Companies

Each UBS SETC Affiliate hereby consents to, and hereby acknowledges UBS’s contractual right to, the offset against or reduction of any earned commissions payable to the UBS SETC Affiliate (or such UBS SETC Affiliate’s controlling person) generated hereunder to reduce amounts due or payable to UBS or any UBS affiliated companies by the UBS SETC Affiliate (or such UBS SETC Affiliate’s controlling person) as a result of such UBS Affiliate’s participation in one or more of UBS’s or its affiliated companies’ other programs, including, without limitation, the UBS ERTC Affiliate Program.

8. Actions of Household Members or Affiliated Parties

UBS considers individuals who share an address, payment method and contact information as members of the same household. This includes instances where addresses may be different, but payment methods and other details are shared.

If any person in an Affiliate’s immediate household engages in any activity which, if performed by the Affiliates would violate any provision of the Agreement, such activity will be deemed a violation by said Affiliates and the Company may take disciplinary action against Affiliates pursuant to these Policies and Procedures. Similarly, if any individual associated in any way with a corporation, partnership, LLC, trust or other entity (collectively “Business Entity”) violates the Agreement, such action(s) will be deemed a violation by the Business Entity, and the Company may take disciplinary action against said Business Entity. Similarly, if an Affiliate enrolls in UBS as a Business Entity, each affiliated party of the Business Entity shall be personally and individually bound to, and must comply with, the terms and conditions of the Agreement.

9. Search Engine Marketing (SEO) and Paid Online Advertising

To avoid brand confusion and protect brand reputation, and in fairness to all, Affiliates are not permitted to purchase sponsored UBS related advertisements on other websites or social media.

Affiliates agree to cooperate fully with UBS in this area so that Search Engines list the UBS website as the top search result when a user makes a query containing the name “UBS”, UBS”, or any other company protected trademark(s) or UBS owned content.

Affiliates may not bid on or purchase (or encourage or solicit any third party to bid on or purchase) any UBS trademark or UBS owned content as a meta-tag, keyword, paid search term, sponsored advertisement, or sponsored link used to trigger search results. If Affiliates wish to use any such meta-tags or search-based advertising programs to advertise UBS Products or the opportunity, they may do so only using generic search terms.

10. Term

The term of this Agreement is month to month and will be renewed automatically. The term will begin upon our acceptance of your application and will end when terminated by either the Company or you upon thirty (30) days’ notice.

11. Constructive Criticism and Violation Reporting

UBS desires to provide its Affiliates with the best services possible. Accordingly, UBS values constructive criticism and encourages the submission of written comments addressed to Company leadership at [email protected]. However, negative and disparaging comments about the Company or other UBS Affiliates or any of UBS’s business partners, including United Business Solutions, Sichenzia or other similar businesses calculated to dampen the enthusiasm of other UBS Affiliates, or potential clients or to disparage UBS, its UBS Affiliates or business partners, either intentionally or unintentionally, represent a material breach of this Agreement and may be subject to sanctions, up to termination of this Agreement immediately notwithstanding the 30 days’ notice provision above, as deemed appropriate by the Company.

Company also values its brand, its business, and the success of its independent UBS Affiliates. Any UBS Affiliate who observes or may be aware of another conducting business in a manner that would constitute a violation of this Agreement or any other agreement that one may have with the Company is strongly encouraged to report such violations at: [email protected].

When possible, it is requested that violations being reported include:

(i) Specific facts to support the allegations;

(ii) Specific sections of which policies may have been violated;

(iii) Dates;

(iv) Individuals or entities involved; and

(v) Any other information that the reporting individual deems applicable to the particular event and would be appropriate for the Company to know in order to perform a full investigation of the matter.

12. Non-Competition

During the term of this Agreement, any UBS Affiliate must not make business referrals or participate in any SETC refund or credit program which is competitive with the UBS SETC Program.

13. Non-Solicitation

You agree that during the period while you are an UBS SETC Affiliate, you will not encourage, solicit, or otherwise attempt to persuade any UBS Affiliate or any potential eligible business to utilize any SETC accounting or other services company other than UBS and Sichenzia.

14. Modification of Terms

Because federal, state, and local laws, as well as the business environment, periodically change, UBS reserves the right to amend this Agreement, the UBS SETC Compensation Plan, and any other agreement between UBS and UBS SETC Affiliate in its sole and absolute discretion.

This section does not apply to the Arbitration clause. The Arbitration clause can only be modified by way of mutual consent of both parties.

Notification of amendments shall appear on the UBS website and in Official UBS materials. Any such amendment, change, or modification shall be effective thirty (30) days following one of the following communication methods (unless exigent circumstances require immediate effectiveness of such amendment):

(i) Posting on the Official UBS corporate website;

(ii) Electronic mail (e-mail); or

(iii) In writing through other UBS communication.

It is the responsibility of each UBS SETC Affiliate to maintain current records of these modifications and to provide any prospective UBS Affiliates with the latest versions. It is also the responsibility of each UBS Affiliate to maintain updated personal records so that UBS has the ability to notify the UBS SETC Affiliate of any changes or to contact the UBS SETC Affiliate for any other matters regarding their affiliation with Company.

15. Termination

In the event of a material breach of this Agreement, UBS reserves the right to terminate this Agreement immediately. Upon cancellation or termination, all property rights are forfeited regarding any rewards, referrals or other remuneration derived through your sales/referrals; provided, however, that any referral fees earned by the UBS SETC Affiliate and thereafter paid to UBS by UBS/Sichenzia shall be paid in accordance with this Agreement and the UBS SETC compensation plan.

UBS reserves the right to terminate all UBS SETC Affiliate Agreements upon thirty (30) days’ notice if the Company elects to: (1) cease business operations; (2) dissolve as a business entity; or (3) terminate distribution of its products via Affiliate channels. No termination of this Agreement will relieve either party for any liability for any breach of, or liability accruing under, this Agreement prior to termination.

- Voluntary Termination

An Affiliate may immediately terminate their Agreement by submitting a written notice, via support ticket at https://app.UBS.global/support/ticket

The notice must include:

(i) The Affiliate’s intent to terminate this Agreement;

(ii) Date of termination requested;

(iii) Affiliate number;

(iv) A reason for terminating;

(v) Signature;

(vi) Valid email to receive Company response.

UBS will respond to the Affiliate’s notice of voluntary termination via email to the email address provided in the termination notice within twenty-four (24) hours. No termination is effective until UBS responds, thus sending the notice is not, in itself, sufficient to complete termination. As a result, any Affiliate who wishes to terminate this Agreement should save the initial termination notice and forward it to Company if the Affiliate receives no response within the twenty-four (24) hour time-period. The termination will go into effect thirty (30) days following its acknowledgement by Company, unless Affiliate wishes to make the termination effective immediately and forfeit all commissions and other outstanding payouts Company may owe to Affiliate. Since UBS does not approve sponsorship changes, Affiliates who request to cancel their account must wait 6 months to re-enroll.

b. Involuntary Termination

UBS reserves the right to terminate an UBS SETC Affiliate with cause for the following reasons:

(i) Violation of ANY of the agreements between the UBS SETC Affiliate and Company including but not limited to: this Affiliate Agreement, the Electronic Signature Affiliate Application, the Privacy Notice, and thw Terms of Use;

(ii) Violation of any applicable law, regulation, ordinance or the like in relation to or in the participation of being an UBS SETC Affiliate; and

(iii) Conduct that Company determines to be detrimental to the Company opportunity or the success of other UBS SETC Affiliates and the continuation of the Affiliates participation in the program is no longer necessary.

This is not an exhaustive list and Company may present further rationale, in its discretion, that termination is valid for a particular Affiliate. In such a case, the Dispute Resolution provision would be the appropriate mechanism for an Affiliate who so wishes to challenge such involuntary termination.

Termination will go into effect thirty (30) days from the day in which Company initiated termination.

16. Independent Contractor Status

An UBS SETC Affiliate is an independent contractor, and not a purchaser of a franchise or business opportunity. Therefore, each UBS Affiliate’s success depends on his or her independent efforts and no particular result is guaranteed. No agreement between Company and its UBS Affiliates creates an employer/employee relationship, agency, partnership, or joint venture between Company and the Affiliate. All Affiliates are responsible for paying local, state, and federal taxes due from all compensation earned as an Affiliate of the Company. Affiliates have no express or implied authority to bind Company to any obligation or to make any commitments by or on behalf of the Company.

As a self-employed independent contractor, you will be operating your own independent business seeking out self-employed individuals who can be referred to UBS and UBS/Sichenzia who might qualify for, and be eligible to receive, SETC refunds or tax credits.

You have complete freedom in determining the number of hours that you will devote to your business, and you have the sole discretion of scheduling such hours. In the event you earn over $600 in a calendar year, you will receive IRS Form 1099-MISC reflecting the amount of income paid to you during the calendar year. It will be your sole responsibility to account for such income on your individual income tax returns.

17. Promoting the SETC Program

You agree to make no representations or claims about the SETC, UBS’s SETC Program, or an individual’s potential SETC refund or credit beyond those in the UBS SETC Program marketing materials and literature. This includes any form of puffery or the like as UBS (including all of its affiliated companies) takes its reputation very seriously and will not permit any type of misrepresentations about UBS, UBS, Sichenzia or participation in the SETC opportunity. The actions of one Affiliate can have a detrimental impact on UBS, other Affiliates, and the entire opportunity. It must be emphasized that the only involvement of an UBS Affiliate is making referrals of self-employed individuals who may be eligible for SETC refunds or tax credits.

18. Taxes

UBS SETC Affiliates will receive a 1099-MISC statement for tax purposes. The 1099 will reflect all income received from UBS.

19. Errors or Questions

If an Affiliate has questions about or believes any errors have been made regarding earned referral fees, commissions, bonuses, or charges, the Affiliate must notify the Company (and the Company will notify UBS, if appropriate) in writing within thirty (30) days of the date of the purported error or incident in question. UBS will not be responsible for any errors, omissions, or problems not reported to the Company within thirty (30) days.

20. Use of Sales Aids

While promoting the SETC Program, Affiliates must use the sales aids and support materials produced by UBS or UBS/Sichenzia. If UBS Affiliates develop their own sales aids and promotional materials (which includes Internet advertising), notwithstanding Affiliates’ good intentions, they may unintentionally violate any number of statutes or regulations affecting an UBS business. Accordingly, Affiliates must submit all written sales aids, promotional materials, advertisements, websites and other literature to the Company for approval prior to use. Unless the Affiliate receives specific written approval to use the material, the request shall be deemed denied. All Affiliates shall safeguard and promote the good reputation of UBS and its products, and that of UBS’s referral partners, including, without limitation, UBS and Sichenzia.

An Affiliate may not build third-party sites that contain materials copied from corporate sources nor create his or her own website to promote the Company without receiving express approval from Company. An Affiliate may not use or attempt to register any of the Company’s trade names, trademarks, service names, service marks, product names, URLs, advertising phrases, the Company’s name or any derivative thereof, for any purpose including, but not limited to, Internet domain names (URL), third party websites, Web pages, or blogs.

21. Intellectual Property

Each UBS SETC Affiliate agrees to use the Trademarks and Copyrights in the form and manner and with appropriate legends as currently used and permitted by the Company. All promotional materials supplied or created by UBS or UBS/Sichenzia must be used in their original form and cannot be changed, amended or altered except with prior written approval from the Company. The name of UBS (including of any UBS affiliated company), each of its product names and other names that have been adopted by UBS in connection with its business are proprietary trade names, trademarks and service marks of UBS. As such, these marks are of great value to UBS and are supplied to UBS SETC Affiliates for their use only in an authorized manner.

22. Proprietary Information, Business Reports, Lists

By completing and signing this Agreement and agreeing to comply with the UBS SETC Program terms of service, you acknowledge that Business Reports, lists of potential businesses and Affiliates names and contact information, and any other information which contains financial, scientific, technical or other information both written or otherwise circulated by UBS pertaining to the business and products or services of UBS (collectively, “Reports”), are confidential and proprietary information and trade secrets belonging to UBS.

23. Jurisdiction and Governing Law

The formation, construction, interpretation, and enforceability of your contract with UBS as set forth in this Affiliate Agreement and any incorporated documents shall be governed by and interpreted in all respects under the laws of the State of Florida without regard to conflict of law provisions.

24. Contract

This Agreement can be executed online (including via UBS’s website), by email or by an electronic signature.

25. Disputes

a. Mediation

If a Dispute arises, the parties shall first attempt in good faith to resolve it promptly by negotiation. Any of the parties involved in the Dispute may initiate negotiation by providing notice (the “Dispute Notice”) to each involved party setting forth the subject of the Dispute and the relief sought by the party providing the Dispute Notice, and designating a representative who has full authority to negotiate and settle the Dispute. Within ten (10) Business Days after the Dispute Notice is provided, each recipient shall respond to all other known recipients of the Dispute Notice with notice of the recipient’s position on and recommended solution to the Dispute, designating a representative who has full authority to negotiate and settle the Dispute. Within twenty (20) Business Days after the Dispute Notice is provided, the representatives designated by the parties shall confer either in person at a mutually acceptable time and place or by telephone or any other electronic means, and thereafter as often as they reasonably deem necessary, to attempt to resolve the Dispute. At any time twenty (20) Business Days or more after the Dispute Notice is provided, but prior to the initiation of arbitration, regardless of whether negotiations are continuing, any party may submit the Dispute to JAMS for mediation by providing notice of such request to all other concerned parties and providing such notice and a copy of all relevant Dispute Notices and notices responding thereto to JAMS. In such case, the parties shall cooperate with JAMS and with one another in selecting a mediator from the JAMS panel of neutrals and in promptly scheduling the mediation proceedings, and shall participate in good faith in the mediation either in person at a mutually acceptable time and place or by telephone, in accordance with the then-prevailing JAMS’s mediation procedures and this Section, which shall control.

b. Arbitration

Any Dispute not resolved in writing by negotiation or mediation shall be subject to and shall be settled exclusively by final, binding arbitration before a single arbitrator in Vero Beach, Florida, in accordance with the then- prevailing Comprehensive Arbitration Rules of JAMS, Inc. No party may commence Arbitration with respect to any Dispute unless that party has pursued negotiation and, if requested, mediation, as provided herein, provided, however, that no party shall be obligated to continue to participate in negotiation or mediation if the parties have not resolved the Dispute in writing within sixty (60) Business Days after the Dispute Notice was provided to any party or such longer period as may be agreed by the parties. Unless otherwise agreed by the parties, the mediator shall be disqualified from serving as an arbitrator in the case. The parties understand and agree that if the arbitrator or arbitral panel awards any relief that is inconsistent with the Limitation of Liability provision in this Section herein, such award exceeds the scope of the arbitrator’s or the arbitral panel’s authority, and any party may seek a review of the award in the exclusive jurisdiction and venue of the federal and state courts of the State of Florida residing in the City of Vero Beach, Indian River County, Florida.

c. Class Action Waiver

THE NEGOTIATION, MEDIATION OR ARBITRATION OF ANY DISPUTE SHALL BE LIMITED TO INDIVIDUAL RELIEF ONLY AND SHALL NOT INCLUDE CLASS, COLLECTIVE OR REPRESENTATIVE RELIEF. IN ANY ARBITRATION OF A DISPUTE, THE ARBITRATOR OR ARBITRAL PANEL SHALL ONLY HAVE THE POWER TO AWARD INDIVIDUAL RELIEF AND SHALL NOT HAVE THE POWER TO AWARD ANY CLASS, COLLECTIVE OR REPRESENTATIVE RELIEF. THE PARTIES UNDERSTAND AND AGREE THAT EACH IS WAIVING THE RIGHT TO TRIAL BY JURY OR TO PARTICIPATE IN A CLASS, COLLECTIVE OR OTHER REPRESENTATIVE ACTION.

To the fullest extent allowed by law: 1) the costs of negotiation, mediation and arbitration, including fees and expenses of any mediator, arbitrator, JAMS, or other persons independent of all parties acting with the consent of the parties to facilitate settlement, shall be shared in equal measure by Affiliate, on the one hand, and Company and any Related Parties involved on the other, except where applicable law requires that Company bear any costs unique to arbitration (which Company shall bear); and 2) the arbitrator or arbitral panel or, in the case of provisional or equitable relief or to challenge an award that exceeds arbitral authority as described in this Section, the court, shall award reasonable costs and attorneys’ fees to the person or entity that the arbitrator, arbitral panel, or court finds to be the prevailing party; provided, however, that if fees are sought under a statute or rule that sets a different standard for awarding fees or cots, then that statute or rule shall apply.

Nothing in this Agreement shall prevent Company from applying to and obtaining from any court having jurisdiction a writ of attachment, a temporary injunction, preliminary injunction, permanent injunction, or other relief available to safeguard and protect Company’s interest prior to, during, or following the filing of any arbitration or other proceeding or pending the rendition of a decision or award in connection with any arbitration or other proceeding.

d. Limitation of Liability

NOTWITHSTANDING ANYTHING HEREIN TO THE CONTRARY OR ANY FAILURE OF ESSENTIAL PURPOSE, IN NO EVENT SHALL AN AFFILIATE OR COMPANY (INCLUDING ANY OF ITS RELATED PARTIES BE LIABLE TO THE OTHER PARTY FOR ANY SPECIAL, INCIDENTAL, INDIRECT, PUNITIVE OR EXEMPLARY, OR CONSEQUENTIAL DAMAGES OF ANY KIND OR NATURE, HOWEVER CAUSED, ARISING OUT OF OR RELATED TO THE AFFILIATE AGREEMENT OR THE SUBJECT MATTER HEREOF (INCLUDING BUT NOT LIMITED TO THE COMPANY SERVICES, THE PROGRAM, COMPANY MARKETING MATERIALS OR COMPANY BUSINESS SUPPLIES), WHETHER SUCH LIABILITY IS ASSERTED ON THE BASIS OF CONTRACT, TORT OR OTHER THEORY OF LIABILITY (INCLUDING BUT NOT LIMITED TO NEGLIGENCE OR STRICT LIABILITY), OR OTHERWISE, EVEN IF THE AFFILIATE OR COMPANY (OR ANY OF ITS RELATED PARTIES) HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES. IN JURISDICTIONS THAT DO NOT GIVE EFFECT TO LIMITED LIABILITY OR EXCULPATORY CLAUSES, THIS PROVISION IS NOT APPLICABLE. IN JURISDICTIONS THAT ALLOW FOR EXCULPATORY OR LIMITED LIABILITY CLAUSES IN A LIMITED MANNER, THIS PROVISION IS APPLICABLE TO THE FULLEST EXTENT ALLOWED BY THE LAW OF SUCH JURISDICTION.

AFFILIATE AGREES THAT IF AN ARBITRATOR WERE TO AWARD DAMAGES, THE AFFILIATE WOULD BE ENTITLED TO RECEIVE NO MORE THAN THE PRICES PAID FOR THE PRODUCTS OR SERVICES COMPANY HAD PROVIDED AFFILIATE AT THE TIME THE DISPUTE AROSE.

26. Indemnification

An Affiliate is fully responsible for all of his or her verbal and/or written statements made regarding Company products, services, and referral fees, which are not expressly contained in Official Company Materials. Affiliate agrees to indemnify Company and hold it harmless from any and all liability including judgments, civil penalties, refunds, attorney fees, court costs or lost business incurred by the Company as a result of the Affiliate’s unauthorized representations or actions. This provision shall survive the cancellation of this Agreement.

27. Consent to Electronic Communications

By using this website your agree and consent to receiving certain electronic communications from us as further described in our Privacy Policy. Communications sent to our members will be done so from an official UBS email address such as [email protected]. Further communications may be sent via SMS text messages from one of the following phone numbers:

+18449757979, +18443973803

Program Description

Subscribers will receive important recurring messages from UBS regarding corporate announcements and new products.

To opt-in, Text JOIN to 18332236406. You will receive recurring messages. Msg&data rates may apply. To opt-out, Text STOP to 18332236406. An opt-out confirmation message will be sent back to you. To request support, Text HELP to 18332236406 or email us at [email protected]. Text messages are sent from an autodialing system. Participation is not required for the purchase of goods or services. Subscribers will receive an SMS message if their device does not support MMS.

Privacy Policy

Please click on the following link to view our Privacy Policy: https://app.ihub.global/page/ubs-privacy-policy

Supported Carriers

This program is supported by Alltel, AT&T, Boost, Sprint, T-Mobile®, Verizon Wireless, Virgin Mobile, MetroPCS, and U.S. Cellular. Products & services are compatible with AT&T handsets. T- Mobile is not liable for delayed or undelivered messages.

28. UBS Endorses the Following Code of Ethics:

UBS SETC Affiliates must show fairness, tolerance, and respect to all people affiliated with UBS, regardless of race, gender, social class or religion;

UBS SETC Affiliates must contribute to and foster an atmosphere of positivity, teamwork, good morale and community spirit.

UBS SETC Affiliates shall strive to resolve business issues, including situations with Upline and Downline members through tact, sensitivity, and good will.

UBS SETC Affiliates must be honest, responsible, professional and conduct themselves with integrity.

UBS SETC Affiliates shall never disparage UBS or any or UBS’s affiliated companies, other UBS SETC Affiliates, UBS’s employees or management, UBS’s referral partners, including United Business Solutions and Sichenzia, other product suppliers or agents, products, services, sales and marketing campaigns, or the UBS SETC Compensation Plan, or make statements that unreasonably offend, mislead or coerce others.

UBS may take appropriate action against any UBS SETC Affiliates if it determines, in its sole discretion, that the Affiliates’ conduct is detrimental, disruptive, or injurious to UBS, or any or UBS’s affiliated companies, other UBS SETC Affiliates, UBS’s employees or management, UBS’s referral partners, including United Business Solutions and Sichenzia, or any other business partners.

29. UBS Products, Subscription, and No-Refund Policy

All Sales Are Final

Please carefully review your order before confirming your purchase. All sales are considered final. We do not offer refunds or exchanges for any products or services sold through UBS or any of its affiliated companies (an “Affiliated Company”).

Non-Refundable Items or Services

All items or services purchased from UBS or any of its Affiliated Companies are non-refundable unless otherwise specified in writing by UBS or its applicable Affiliated Company. This policy applies but is not limited to:

- Digital Products

- Gift Cards

- Software Licenses

- Subscription Services

- Custom-made Items

- Sale Items

You understand, agree and authorize UBS or its Affiliated Company to bill your credit card or bank account for purchases that you have made through the UBS or Affiliated Company website or app. UBS or Affiliated Company purchases on your Bank Statement will be shown as "UBS" or other Statement Descriptors from it's Affiliated Companies. All terms, conditions apply.

You also understand and agree to this Terms of Service and accept and agree that is it against UBS's and its Affiliate Companies’ Terms of Service to make a credit card charge-back via your banking provider for any transaction from UBS or its Affiliated Company, and by doing so UBS and its Affiliated Companies retain the right to terminate any account at their discretion. UBS and its Affiliated Companies retain the right to recoup associated chargeback fees and fines from any due commission or payments.

How to Contact Us

For any questions or concerns regarding this No Refund Policy, please submit a support ticket here: https://setc.ubspartners.app/ticket. We reserve the right to modify this No Refund Policy at any time, effective upon posting of an updated version on our website. Please regularly check this TOS for updates.